Third installment of our new blog series that will bring front-row insights from our global network of IMRs focusing on COVID-19 recovery efforts in different markets. This installment is about South Korea

As international export markets begin recovering from the COVID-19 pandemic, it is important to stay up to date on how your target markets are doing.

Food Export-Midwest and Food Export-Northeast have developed a new blog series that will bring you front-row insights from our network of In-Market Representatives (IMRs). Each blog will focus on one international market and give an overview of the recovery efforts in that market. This time we’ll examine South Korea.

This week’s spotlight is all about South Korea. Learn about the changes that took place in these markets as a result of COVID-19 and practical tips that our In-Market Representatives (IMRs) for South Korea, Ken Yang and Kristie Park have to offer to U.S. exporters looking to enter or re-establish themselves in the market.

1. What is the situation in your market regarding pandemic recovery at present?

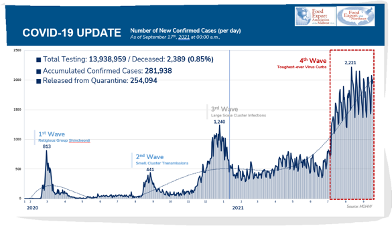

South Korea has been facing the 4th wave of COVID-19 pandemic since early July 2021, with daily confirmed cases of 1,500-2,000. Close to 70% of the population received a first dose of the vaccine before the Korea’s Chuseok holidays (September 20-22). The Ministry of Health targets to have 70% of the population fully vaccinated before November.

Korea’s major metropolitan cities are still placed under Level 4, the highest level of social distancing which limits the number of people gathering at restaurants and cafés to 6, impacting small business owners.

As of September 6, South Korea started distributing another round of disaster relief funds to help revive the economy. Each individual in the lowest 80% income bracket, almost 88% of the population, will receive about US$215. These funds can be spent at most small neighborhood businesses like traditional markets, local supermarkets, restaurants, and franchised convenience stores or cafes, though cannot be spent at department stores, malls, large supermarket and chain stores. This US$11 billion infusion is expected to help the revitalization of the nation’s economy.

2. How is that playing out in the food sector? What are you seeing in the retail sector? foodservice sector? Is there anything to note in specific industry sectors such as feed, pet food or seafood?

South Korea is known to be one of the markets where the pandemic is well managed, however, the pandemic still has impacted the South Korean economy and influenced food consumption.

In 2020, South Korea maintained US$475.2 billion in retail sales thanks to the strong growth in online retail sales. Offline retail sales in 2020 reached US$376 billion, a 4.5 percent decrease from 2019’s $394 billion, while online sales reached $99 billion in 2020, a 23.7 percent increase from $80 billion in 2019. In 2021, overall retail sales have grown in comparison with 2020, through rising consumer confidence around economic recovery. The combined sales of major online and offline retailers jumped 11.6 percent in the first quarter alone.

Local consumers are looking for meal kits, home-meal replacements, or ready-to-cook products, as more people cook and eat at home due to the pandemic and also due to the culture of the MZ generation (MZ generation refers to the combination of Millennials (those born 1981-1995) and Generation Z (those born 1996-2005) consumers.), who like to post their cooking process on social media. The local food industry estimates that the domestic meal-kit market will grow to $300 million in 2021 and to $700 million by 2024.

Within the alcoholic beverage market, both demand and imports of wines have increased. Total wine imports amounted to $330 million in 2020, surpassing $300 million for the first time. From January to April 2021, imports already reached to $182.4 million with the U.S. as the 3rd largest supplier to South Korea after France and Chile.

The Korean food processing industry recorded its highest performance in 2020. Overall sales increased by 8.5 percent on average last year. In 2021, food processing is expected to continue to grow due to the rapid spread of the trend of cooking and eating at home. The industry is preparing for the post-COVID-19 era by expanding its existing offerings now and focusing on overseas exports as well. Domestic food processors and manufacturers are using imported products for raw materials, especially grains, and the U.S. is one of the largest suppliers for the South Korean market.

The food service sector is heavily impacted by the strict social distancing requirement and limitation of operation hours and is still struggling to recover from the pandemic. The food service sector has started to expand meal delivery; accordingly, online meal deliveries soared by 78 percent in 2020-21.

For the pet food market, there are 15 million South Koreans living with companion animals such as dogs and cats. Because of the increase in one or two member-households, the change in lifestyle, the low birth rate and aging population, the number of pet owners continues to increase. The effects of the COVID-19 are also contributing to the increase in pet households. The size of the pet market is expected to reach $6 billion by 2027 from $3.3 billion in 2020. In the pet food market, premium feed is in the spotlight due to the “pet humanization” phenomenon, in which owners view pets as full members of the family. As pet owners are paying attention to the health of their pets, demand for natural food using natural and organic ingredients and human-grade food using quality materials and processes is increasing. Local market players are focusing on premium pet food while around 70% of products are imported from the overseas.

3. Have there been any structural changes in the market – ex. consolidations or ongoing issues related to imports (ex. testing) of which U.S. suppliers should be aware?

COVID-19 has disrupted food supply chains around the world. Since South Korea is heavily depending on imports of food and agricultural products from overseas, the most pressing concerns are increasing freight costs, shipment delays and lack of available containers. Local food importers and distributors are facing challenges both from increased cost of logistics – almost triple from 2019 – and the pressure of lower-priced product suppliers to retail chains. The physical distancing associated with lockdowns and lack of skilled farm labor in countries supplying food exports to South Korea have negatively impacted food prices and timely shipments. Though increased consumer spending through meals prepared at home and stocking up on groceries and supplies have boosted sales, distributors and importers have been significantly challenged by the shortages of overseas food supplies and increased freight costs.

4. What trends or developments have you seen in your market during the pandemic that you think are most likely to continue into the recovery and post-recovery period?

The most noticeable phenomenon during the pandemic years is that, just like other global markets, the e-commerce market has been growing explosively. South Korea is considered the 5th largest e-commerce market after China, the U.S., the U.K., and Japan. From 2009 to 2020, the market posted a record 22.7% growth by CAGR (Compound Annual Growth Rate). Its total transaction volume, which stood at $20.6 billion in 2009, jumped to $159.4 billion in 2020. Food sales via online or ecommerce platforms tripled to $43.2 billion in 2020, which include $19.6 billion in food & beverages, $6.2 billion in agricultural, livestock and seafood products, and $17.3 billion in food delivery services. The most popular top 10 products include healthy foods, healthy food for babies, cereal, raw material snacks, yogurt, HMR/Meal-Kits, Bakery products/jam/syrup, desserts, candy/jelly, and snacks.

Picky Consumers: As South Korea’s birth rate is maintained as low; parents always want to provide their children with premium quality goods. Consistent with this trend, the baby food market has surged due to an increase in the number of double-income parents who don’t have enough time to make baby food by themselves and the enhanced quality of delivery services. Parents who are sensitive about higher fat and sodium content in regular snacks are switching to low-fat and low-sodium products specific to infants and children. The popularity of ingredients that can simplify making baby foods such as rice powder, vegetable powder, oatmeal, vegetable cubes and chopped vegetables have also emerged as key products. Ready-to-eat products are also gaining attention in pouch type packaging that can be stored at room temperature and are easy to carry.

There is also increased interest in healthy foods. As health-oriented food consumption trends take hold amid the pandemic, immune-enhancing and functional foods have become popular and consumers are concerned about ensuring food safety. This has prompted a growing interest in the manufacturing process and country of origin of foods. As demand for healthy and safe foods rise, consumption of organic foods has also climbed in line with the trend.

Some other trends in food consumption that the South Korean In-Market Representatives have noticed are:

5. Could you share some practical marketing tips for U.S. suppliers to best position themselves to take advantage of the trends/developments you identified above?

South Korea’s food culture has become diverse with an abundance of food sources from all over the world. Local consumers have also developed palates for new flavors and ingredients, relishing foreign cultures and cuisines. Below are recommendations and suggestions for US suppliers who are seeking to venture into the South Korean food market.

First, find the right partner – a local partner is vital to a successful entry into the market. The break-neck pace of changing trends translates into an emphasis on promotions and marketing. Furthermore, the country has strict rules and regulations on imported foods and importers will have to navigate through complex e-commerce market structures. South Korean buyers and distributors who have an in-depth experience in food distribution and trends in food consumption would be considered ideal partners. Developing an entry strategy for a new brand requires a long-term vision.

Second, check the local consumer trends – it is strongly recommended to monitor the frequently changing consumption trends in Korea. As more consumers become conscious of their health, the sales of health supplements, functional foods, or health-related food products such as no-additive, non-GMO, gluten-free, vegan products, and fresh produce will increase. Also, advanced healthy meal kits or home-meal replacements custom-designed for these consumers will see high demand.

Lastly, understand local business practices. When consumers purchase food products, savvy consumers most likely know about products or ingredients already as they obtain information easily via social media or online. It is important for U.S. suppliers to provide not only quality food products but also collaborate on promotion and marketing supports with their buyers, distributors and retailers. Various activities such as online retail banners, special price discount events, or social media marketing efforts to increase brand name recognition might help to increase the sales successfully.

Check out the Food Export’s South Korea Country Profile for further details.

Do you have specific questions for our market expert?

Consider a 30-minute video Virtual Consultation.

Your Connection To Growth®

©2024 Food Export Association of the Midwest USA and Food Export USA–Northeast. All Rights Reserved.

Food Export–Midwest and Food Export–Northeast prohibits discrimination in all its programs and activities on the basis of race, color, national origin, religion, sex, gender identity (including gender expression), sexual orientation, disability, age, marital status, familial/parental status, income derived from a public assistance program, political beliefs, reprisal or retaliation for prior civil rights activity. (Not all bases apply to all programs.) Persons with disabilities who require reasonable accommodations or alternative means of communication for program information (e.g., Braille, large print, audiotape, American Sign Language, etc.) should contact us. Additionally, program information may be made available in languages other than English.

To file a program discrimination complaint, complete the USDA Program Discrimination Complaint Form, AD-3027, found online https://www.ascr.usda.gov/filing-program-discrimination-complaint-usda-customer.

Food Export–Midwest and Food Export–Northeast reserve the right to deny services to any firm or individual which, in the sole opinion of Food Export–Midwest and Food Export–Northeast, does not comply with FAS, MAP or Food Export–Midwest and Food Export–Northeast regulations or policies, or otherwise offer the best opportunity to achieve its mission of increasing food and agricultural exports. Submission of any false or misleading information may be grounds for rejection or subsequent revocation of any application or participation. Food Export–Midwest and Food Export–Northeast are equal opportunity employers and providers.