Mexico is a natural market for U.S. suppliers thinking of exporting their food and agricultural products. Learn more about the market and if your products might be a good fit for this potential export destination in our Country Market Profile.

Mexico is a natural market for U.S. suppliers thinking of exporting their food and agricultural products.

The geographical advantage of a long land border and a long history of bilateral trade between the two countries allows U.S. suppliers many opportunities to establish relationships with Mexican buyers.

Free Trade Agreement

In 2018 the United States announced that it was working on a tri-lateral trade agreement between Mexico and Canada called the United States – Mexico – Canada Agreement or USMCA for short.

The deal has yet to be finalized or implemented but it is expected that the final version will have many benefits for U.S. exporters of food and agricultural products. We will keep you updated as this agreement is finalized and any changes that it brings to the U.S. – Mexico trade landscape.

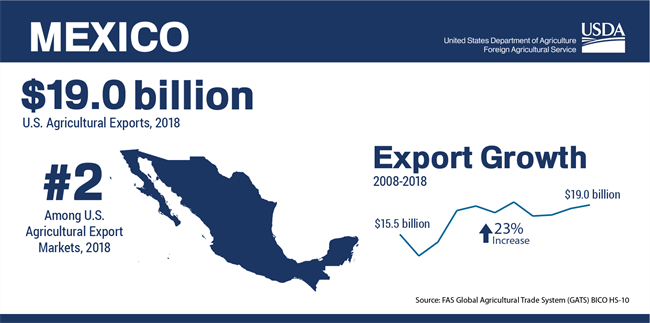

The USDA’s Agricultural Trade Office (ATO) in Monterrey reports that Mexico continues to be one of the largest and fastest growing markets for U.S. agricultural products.

In 2018 the USDA’s Foreign Agricultural Service ranked Mexico as the #2 destination for U.S. ag exports with a total of $19 Billion dollars in U.S. agricultural exports, a 23% increase over the last 10 years.

Mexico is the 2nd largest export market for consumer ready products

——————————————————————————————-

U.S. exports of consumer-ready food products added up to $8.3 Billion in 2017

——————————————————————————————–

In 2017 Mexico imported $5.8 Billion worth of U.S. processed foods, an increase of 2% and the 2nd highest ranking in the world.

Top processed food exports to Mexico in 2017 included:

Advantages to U.S. exporters

There are many advantages for U.S. suppliers exporting to Mexico, we’ve highlighted several of them below.

Retail Sector

In the video below our In-Market Representative for Mexico Raul gives an overview of some of the food trends you can find in the Retail Sector.

The landscape of the Mexican retail market is evolving. A more educated population, expansion of urban lifestyle in small cities, credit availability, and the growing Double Income No Kids (DINK) couples, open up possibilities to import products of high quality and value. As a result of these changes retailers are expanding their high-end formats so imported products are most attractive for consumers.

——————————————————————————-

By the year 2022, the retail sales in the packaged food market in Mexico is expected to reach US$53.5 billion, a growth rate of 8.7%

——————————————————————————-

Food Service Sector

Mexico is an attractive market for international food service companies. The food service industry in Mexico includes the hotel, restaurant, and institutional (HRI) sectors.

Restaurants are the biggest segment by number of outlets. However because of the socioeconomic categories it targets, hotels are often a better opportunity for imported products. There are many diverse export opportunities for U.S. suppliers of food and beverages that are interested in this market, especially in the restaurant and hotel sector because of a growing number of foreign and domestic tourists that visit Mexico. The National Restaurant Chamber (CANIRAC) divides the Mexican restaurant market into four categories:

New concepts in restaurants and hotels with non-traditional cuisines, particularly Asian (Thai, Chinese, Japanese, Indian etc.) are consolidating throughout the country. Mexican consumers have a strong and growing preference for oriental cuisine.

The following products have high sales potential in the hotel food service segment, but it is important to highlight that the volumes required might be small, so exporters should take this into account.

Food-Processing Sector

Mexico has a relatively strong food processing industry, growing at a rate of almost 4%, and with a market value of almost US$135 billion as of 2016.

Leading Mexican brands have well-developed national distribution networks, are well positioned in the market, and enjoy high brand awareness with very loyal consumers. However, a new class of Mexican consumers is demanding products that are healthy, convenient, and innovative. So food processors are adapting to these new demands, including establishing relationships with foreign food processors.

The majority of the food processing sector in Mexico is dominated by multinational (both domestic and foreign) corporations, but there is a large and growing opportunity for small to medium companies to participate in this industry.

Key market drivers for the food processing sector include:

Private label products are popular among the masses and in lower socioeconomic levels since they offer unit prices which are significantly lower than those of the leading brands while maintaining good quality.

Best prospects for U.S. exporters in the food processing sector include:

Market Builder

Thinking of exporting to Mexico but want to do more research first? Take advantage of our Market Builder program which provides customized research to help your company uncover potential in international markets.

Upcoming Activities

We have a number of upcoming activities still open for registration in Mexico for 2019! Read below to see which one might be a fit for you and your product.

Food Show PLUS! at BARRA MEXICO 2019

Focused Trade Mission to Mexico for Feed Ingredients

Focused Trade Mission to Mexico for Private Label, Food Service, and Retail Products

Our In-Market Representative for Mexico shares some information about our upcoming Focused Trade Mission to Mexico for Private Label, Food Service, and Retail Products.

Food Show PLUS! at Food Technology Summit & Expo 2019

Buyers Missions – Mexican Buyers attend our Buyers Missions all over the U.S.

Success Stories

See how other U.S. suppliers found success exporting their products to the Mexican Market in the Success Stories below!

Focused Trade Mission Increases Sales for Illinois Supplier

Focused Trade Mission to Mexico Initiated Partnerships & Export Sales for New York Company

Food Export Resources

Enter New Markets

Market Builder – Mexico

Export Education

Mexico Food Trends Update

Other Resources

Foreign Ag Service GAIN Report: Exporters Guide

Foreign Ag Service GAIN Report: Food Service – Hotel Restaurant Institutional

Foreign Ag Service GAIN Report: Exporting to Mexico – Managing Issues at the Border

Your Connection To Growth®

©2024 Food Export Association of the Midwest USA and Food Export USA–Northeast. All Rights Reserved.

Food Export–Midwest and Food Export–Northeast prohibits discrimination in all its programs and activities on the basis of race, color, national origin, religion, sex, gender identity (including gender expression), sexual orientation, disability, age, marital status, familial/parental status, income derived from a public assistance program, political beliefs, reprisal or retaliation for prior civil rights activity. (Not all bases apply to all programs.) Persons with disabilities who require reasonable accommodations or alternative means of communication for program information (e.g., Braille, large print, audiotape, American Sign Language, etc.) should contact us. Additionally, program information may be made available in languages other than English.

To file a program discrimination complaint, complete the USDA Program Discrimination Complaint Form, AD-3027, found online https://www.ascr.usda.gov/filing-program-discrimination-complaint-usda-customer.

Food Export–Midwest and Food Export–Northeast reserve the right to deny services to any firm or individual which, in the sole opinion of Food Export–Midwest and Food Export–Northeast, does not comply with FAS, MAP or Food Export–Midwest and Food Export–Northeast regulations or policies, or otherwise offer the best opportunity to achieve its mission of increasing food and agricultural exports. Submission of any false or misleading information may be grounds for rejection or subsequent revocation of any application or participation. Food Export–Midwest and Food Export–Northeast are equal opportunity employers and providers.