Find out why China is one of the biggest export markets in the world for U.S. products in our Country Market Highlight blog. Market overview, regional breakdown, Success Stories, upcoming activities and MORE!

This month’s Country Highlight blog will focus on the export market of China.

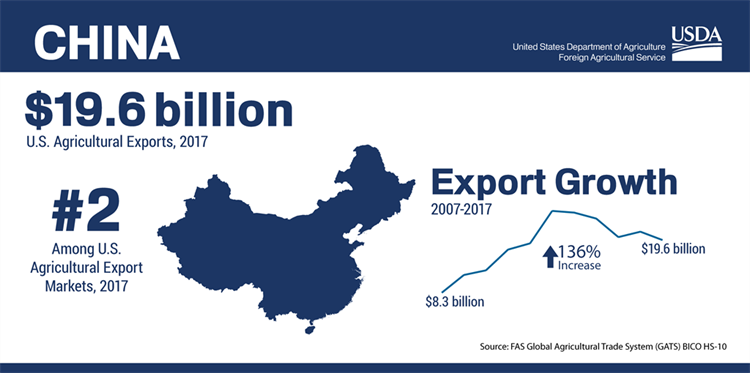

China is one of the largest export markets in the world, and in 2017 the USDA’s Foreign Agricultural Service (FAS) ranked it as #2 among U.S. agricultural export markets. As you can see in the graphic below the market has seen tremendous growth in the last 10+ years.

From 2007 – 2017 it increased 136% most recently clocking in at 19.6 Billion dollars.

As you may know 2018 was a year of many changes in the trade relationship between the United States and China, and there is still a lot of unknown and outstanding issues to resolve.

However, it is important to understand that there are still A LOT of opportunities in China. As with other relationship based Asian countries, making and maintaining relationships with buyers and distributors is just as important as ever. Make sure to keep your eye on the market, once things settle down it will be just as vital as ever for many companies export marketing strategies.

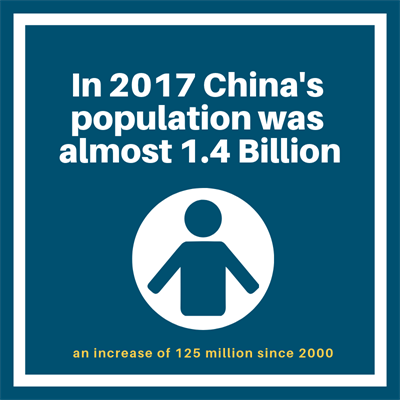

In 2017 China’s population was almost 1.4 Billion, an increase of 125 million since 2000. The population is growing at a decelerating pace, and the country is ageing at a rapid pace. In 2017 the median age was 37.9 years. 10.7% of the population or 148 million people were 65+.

———————————————————–

In 2017 U.S. exports of consumer oriented food products to China increased 12% to $2.4 billion.

———————————————————–

China remains the 6th largest market for consumer ready food products from the U.S.

———————————————————–

And the 5th largest market for the export of U.S. processed foods.

———————————————————–

Totaling nearly 1.9 Billion in 2017 an increase of 10% from the prior year.

———————————————————–

Advantages for U.S Exporters

The U.S. has some competitive advantages in supplying food products to the Chinese market, including:

China is a large country consisting of a variety of smaller regions with unique populations, tastes, and market availability. Find out more about the strategy required to export to the various regions of China in this helpful video from our In-Market Representative for China.

There are 5 major regions in China to consider when exporting, South China, North China, East China, Southwest China, and Northeast China.

Learn a little bit more about each region and their top municipalities below.

South China

North China

East China

Southwest China

Northeast China

Wondering if your company can be successful in China?

Learn from others who have gone before you. Click the links below to read about successes that our participating suppliers have had in the Chinese market.

Iowa Supplier Expands Export Sales to China with Branded Program

Gaining Contacts & Export Sales in China

Delaware Supplier Increases Exports to China

New York Pet Food Supplier Gains Export Sales to China

Now that you know more about the Chinese market it’s time to start exploring all of the activities we have available in 2019! Click below to learn more about each event, add it to your wishlist, or register today!

Food Show PLUS!™ at Food Ingredients China 2019

Food Show PLUS!™ at HOTELEX Shanghai 2019

Food Show PLUS!™ at Bakery China 2019

Food Show PLUS! at SIAL China 2019

Food Show PLUS!™ at China International Food, Meat & Aquatic Products Exhibition 2019 (FMA CHINA)

Food Show PLUS! at CBME China

Food Show PLUS!™ at Pet Fair Asia 2019

Food Show PLUS at VIV Qingdao

Focused Trade Mission to China for Retail Products

Food Show PLUS!™ at the China Fisheries and Seafood Expo

Food Show PLUS!™ at Food & Hotel China

Food Show PLUS!™ at ANUFOOD China

Food Show PLUS!™ at China International Pet Show (CIPS 2019)

Not ready to make the commitment of travelling to China? That’s ok! We frequently have Chinese buyers participate in our domestic U.S. Buyers Missions – check out a full list of 2019 Buyers Missions that are available for registration. *Note the available country buyers vary at each event and are not all known at this time.

To learn more about the Chinese market be sure to read Food Export’s full-length Country Profile.

We aren’t the only ones with great resources when it comes to exporting to China! Here are a couple others we’ve compiled that may be helpful to you.

FAS – Despite Continued Challenges, China Offers Huge Potential for U.S. Farm Exports

USTR – China, Mongolia & Taiwan

Want to discuss the possibility of exporting to China? Feel free to reach out to the Food Export Liaison assigned to your state to learn more and get some helpful resources to get you started.

Your Connection To Growth®

©2024 Food Export Association of the Midwest USA and Food Export USA–Northeast. All Rights Reserved.

Food Export–Midwest and Food Export–Northeast prohibits discrimination in all its programs and activities on the basis of race, color, national origin, religion, sex, gender identity (including gender expression), sexual orientation, disability, age, marital status, familial/parental status, income derived from a public assistance program, political beliefs, reprisal or retaliation for prior civil rights activity. (Not all bases apply to all programs.) Persons with disabilities who require reasonable accommodations or alternative means of communication for program information (e.g., Braille, large print, audiotape, American Sign Language, etc.) should contact us. Additionally, program information may be made available in languages other than English.

To file a program discrimination complaint, complete the USDA Program Discrimination Complaint Form, AD-3027, found online https://www.ascr.usda.gov/filing-program-discrimination-complaint-usda-customer.

Food Export–Midwest and Food Export–Northeast reserve the right to deny services to any firm or individual which, in the sole opinion of Food Export–Midwest and Food Export–Northeast, does not comply with FAS, MAP or Food Export–Midwest and Food Export–Northeast regulations or policies, or otherwise offer the best opportunity to achieve its mission of increasing food and agricultural exports. Submission of any false or misleading information may be grounds for rejection or subsequent revocation of any application or participation. Food Export–Midwest and Food Export–Northeast are equal opportunity employers and providers.